- Home

- English to Italian Translation Services

-

FREE RESOURCES

-

Citizenship by Descent: Free Guide

>

- 5 Benefits of Italian Dual Citizenship

- 14 Documents Needed for Italian Dual Citizenship [Free Checklist]

- Citizenship by Descent: Get it in ITALY

- Gaining Italian Citizenship via Female Ancestors

- Italian Dual Citizenship: Get it Through the Courts

- Reacquisition of Italian Citizenship

- Price of Italian Citizenship: How Much Will it Cost?

- How long does it take to get Italian citizenship?

- Citizenship by Marriage >

- Canadian-Italian Dual Citizenship

-

Citizenship by Descent: Free Guide

>

- Blog

- Contact

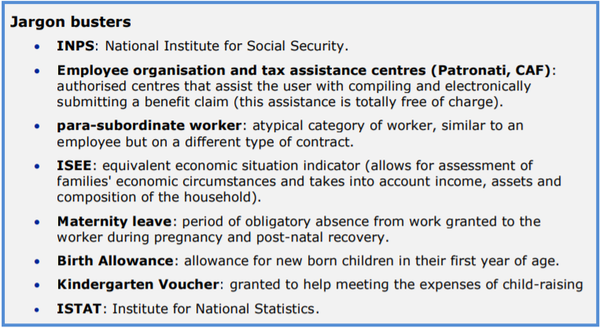

Do you want to move to Italy to work but you don't know about Social Security? We will try to clarify it with this article and the with next ones on the big world of Italian social security. This first article speaks about family The Italian social security system is funded by contributions paid by employed workers, employers, independent workers and self-employed workers and through general taxation. The National Health Service (SSN) is funded by all residents of Italy through taxes, as well as through co-payment of the cost of medicines and health services through payment of what is referred to as the 'ticket', and managed by the individual regions through the Local Health Authorities (LHA). If you belong to any of the categories of workers indicated below, you are insured by the National Institute for Social Security (INPS):

THE LIST OF FAMILY BENEFITS IN ITALY In Italy there are different kinds of family benefits:

WHEN CAN YOU CLAIM? It depends on certain income conditions, you are entitled to ANF if you belong to one of these categories: employees of Italian companies operating in Italy or abroad; pension holders or recipients of cash benefits deriving from employed work. Your household may consist of:

If your household is on a low income and is made up of at least three minor children whose mother does not work, you can claim the Local Authority Allowance granted by your Local Authority of residence. Birth Allowances is granted for 1 year after childbirth. Kindergarten Voucher: not granted to mothers who are exempted from the payment of public nursery services; other forms of home care assistance are provided in the case of disabled children. WHAT CONDITIONS DO YOU NEED TO MEET? Income gross of tax or deductions at source, by way of tax or replacement tax, must also be considered. You are entitled to the allowance if your household income comes from employment income or income deemed as such, by at least 70% and is lower than the limits established annually by Law and vary according to family unit composition. If you are a subordinate worker, at least 70% of this income must come from paid employment. If you are a para-subordinate worker with a fixed-term contract registered under a separate INPS scheme, at least 70% of this income must be made up of employment income. ANF benefit recipients: • you, as a claimant; • your spouse or partner in a civil union, unless legally separated or divorced; • your children (including adoptive children), resident either in Italy or another EU country or a third country with whom a social security or reciprocity agreement has been signed; • your grandchildren (up to the age of 18 and over 18, if disabled). Family Allowance for pensioners for retired persons as long as the person's entitlement to a pension subsists and, therefore, as long as the access requirements continue to be met. The household income limits to be taken into account are re-assessed each year due to planned inflation. For Local Authority income support, the income limits to be taken into consideration are re-assessed each year due to planned inflation, rounding to the nearest euro cent. Birth Allowance is granted until the newborn child is one year old or for one year as of the date of adoption Kindergarten Voucher, means-tested and granted upon submission of the household ISEE. What are you entitled to, and how can you claim? Concerning amounts and forms to fill you can find more details on the INPS Website or Patronato and Caf See below for links to European Commission publications on social security coordination: • http://europa.eu/youreurope/citizens/family/children/benefits/index_en.htm. if you need to translate your documents see my website.I can help you!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorI'm Natalia Bertelli, an English/Spanish to Italian legal translator. Since 2008 I have been working on contracts, judicial deeds, certificates, corporate translations for foreign clients who want to do business in Italy, get a dual citizenship or simply settle in my beautiful country. Categories

All

|

NATALIA BERTELLI, ENGLISH TO ITALIAN SWORN TRANSLATOR

ENGLISH TO ITALIAN LEGAL TRANSLATIONS | SWORN TRANSLATOR | TRANSLATOR COACH | ATA MEMBER

LISTED ON THE UK.GOV AND IN THE US EMBASSY LIST OF TRANSLATORS

Intl. calls: +39 338 263 7469 (Claudia, Project Manager)

[email protected]

VAT No. 01404870295

Privacy Policy

ENGLISH TO ITALIAN LEGAL TRANSLATIONS | SWORN TRANSLATOR | TRANSLATOR COACH | ATA MEMBER

LISTED ON THE UK.GOV AND IN THE US EMBASSY LIST OF TRANSLATORS

Intl. calls: +39 338 263 7469 (Claudia, Project Manager)

[email protected]

VAT No. 01404870295

Privacy Policy

- Home

- English to Italian Translation Services

-

FREE RESOURCES

-

Citizenship by Descent: Free Guide

>

- 5 Benefits of Italian Dual Citizenship

- 14 Documents Needed for Italian Dual Citizenship [Free Checklist]

- Citizenship by Descent: Get it in ITALY

- Gaining Italian Citizenship via Female Ancestors

- Italian Dual Citizenship: Get it Through the Courts

- Reacquisition of Italian Citizenship

- Price of Italian Citizenship: How Much Will it Cost?

- How long does it take to get Italian citizenship?

- Citizenship by Marriage >

- Canadian-Italian Dual Citizenship

-

Citizenship by Descent: Free Guide

>

- Blog

- Contact

RSS Feed

RSS Feed